Abound Credit Union creates possibilities for your financial future in Kentucky and beyond.

Your Free Checking gives you access to helpful money management tools like a Free Visa® Debit Card, Online and Mobile Banking and more, all while having no fees.

Your Certificate Account provides higher interest rates than most traditional savings accounts. The longer your term, the higher your return.

We make getting your home as hassle-free as possible with financing options for every situation.

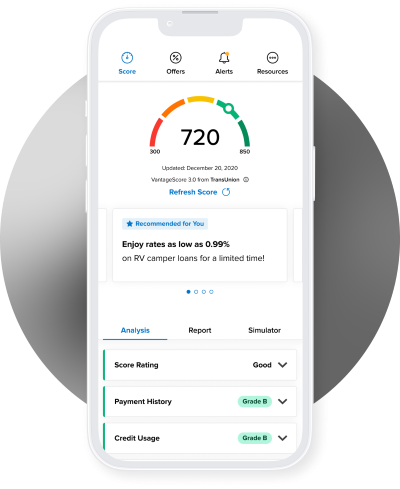

Access your credit score, credit monitoring and more with Savvy Money!**

Financial wellness in every direction.

Banking is only the beginning.

Your financial journey starts here.

Improving the lives of Kentuckians, everyday.

We help our communities learn financial responsibility.

Have Questions?

We help you find answers.

**Carrier rates may apply for data usage.

1 Abound will apply $1,000 in credit towards closing costs at the time of closing. Abound’s $1,000 closing cost gift to applicants may be discontinued at any time and without notice. Refinances of current Abound Home Loan products are not eligible for this promotion.

2 If, over the course of the 24 months following original loan closing date, rates drop from the original mortgage loan rate, the loan holder may request a one-time rate adjustment within the same credit tier for which the loan holder previously qualified. The loan must remain as the same type and term as the original loan. Adjustable Rate Mortgages(ARMs) and Veteran’s Administration (VA) loans are not eligible for a reduction in rate through the rate drop program.